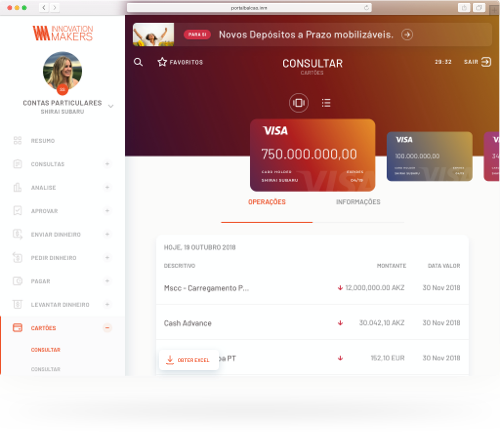

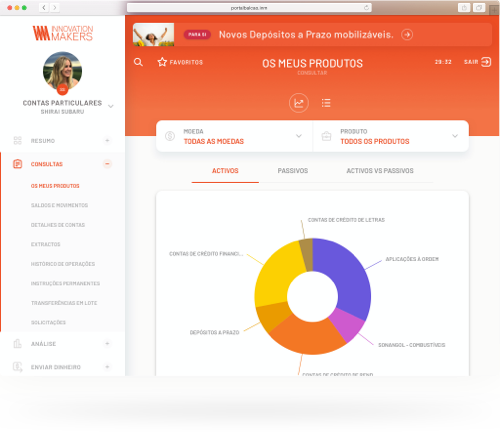

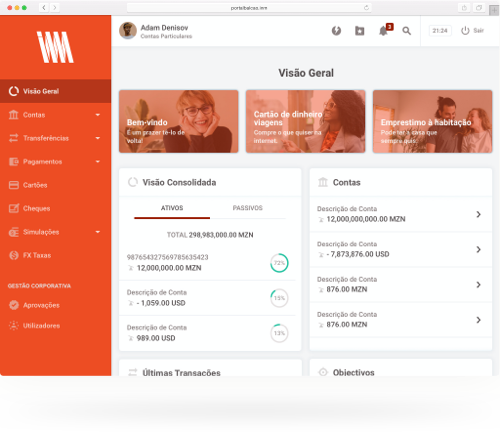

Internet Banking

Internet Banking is an essential channel for all banks undergoing digital transformation. An online tool for accessing private or business accounts and performing all operations without the need to go to a branch.

Through a strong presence on the internet, banking institutions have a privileged channel to their customers, providing information and services 24 hours a day. They thus reinforce proximity, convenience and brand loyalty.

With Internet Banking, organisations provide all key banking operations and a permanent service offering, reducing operating costs and strengthening the relationship with clients.

This channel can be fully developed according to the needs of the business and user, or adapted from existing INM solutions, depending on the strategic plan of each organisation, adjusted to the stipulated investment and implementation time.