Banking Agent

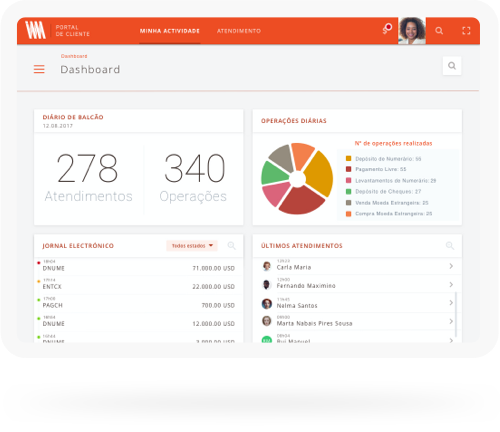

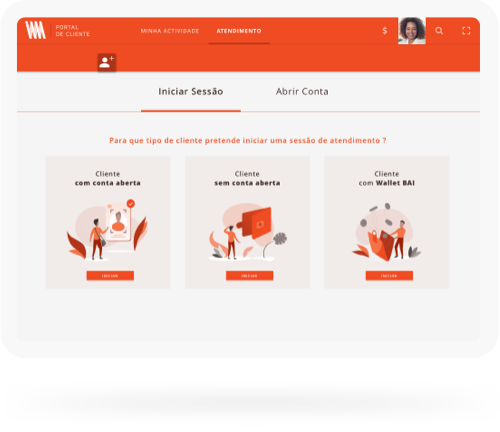

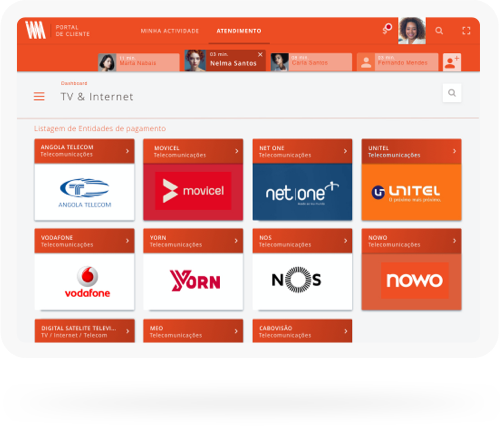

Banking Agent allows entities to expand their network of products and services without the logistical investment and burden that normally requires specific infrastructure. Easily adapted and integrated into the technological and digital solutions of partners.