Counter Portal

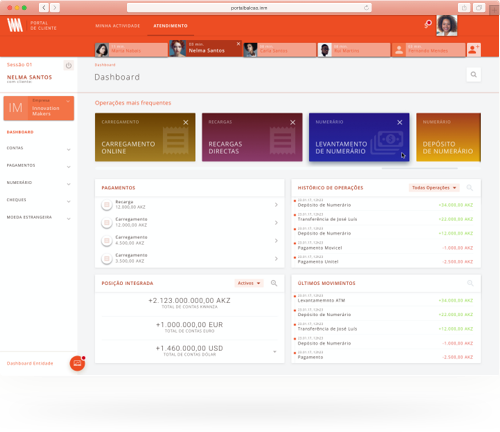

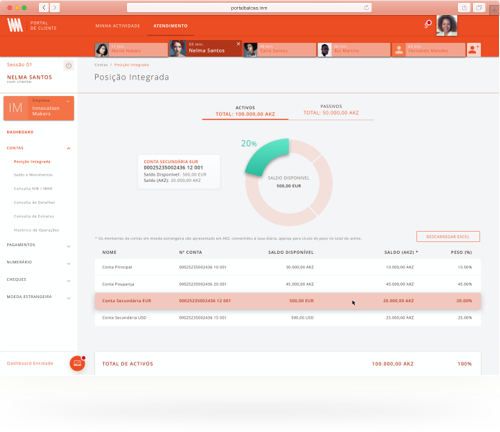

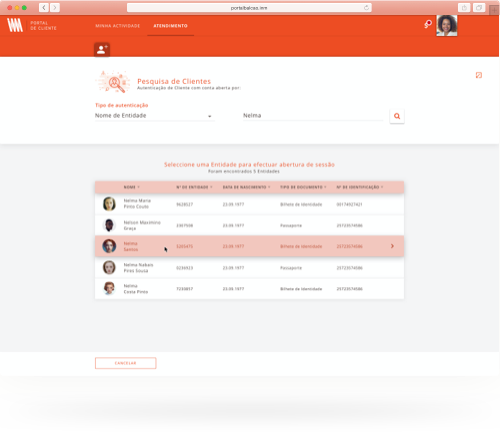

Counter Portal allows financial entities to provide employees with a tool for managing in branch activities and providing a high level of service, through a detailed and relevant 360º view of the client.

Currently, the branch counter shares client interaction with new digital financial channels, although in many cases it remains the channel of choice for the most complex operations. It is therefore critical to make the most of the customer's presence and ensure meaningful and profitable experiences.

This digital counter and teller interface product allows organisations to rely on high-performance technological solutions, which provide employees with a tool for backoffice and in branch activity management, as well as timely information to streamline interactions through a detailed and relevant 360º view of the client.